Check out the comment posted by a InvestingDecoded reader on the previous post about Motorola's DROID. Definitely some good insights there. Feel free to share your thoughts on that or any other post as well!

Yesterday it was announced the GM's deal to sell its Saab brand had fallen apart because the buyer pulled out. Koenigsegg, the Swedish sports car maker who had initially agreed to buy the struggling brand, said that it was having trouble coming to a consensus with partner investors on how to take the brand forward once the acquisition was complete.

Whether that was the actual reason or not, I believe that this incident is just another example of the challenges that GM will continue to face as it tries to conecntrate its efforts on its core brands (i.e. Buick, Chevy, Cadillac, and GMC) and shed non-core assets. It also provides further evidence of what I've though for several months already - there's opportunities here that competing carmakers can take advantage of here and opportunities where investors can capitalize.

It's Been a Long Year

2009 has been the toughest year in the century long history for the American automakers. 2 of "The Big 3" have declared bankruptcy, and government money was injected to keep them from going completely under. I've written extensively on what I think is the reason behind the downfall, so I won't rehash previous posts. But what has happened here with GM I think is a good example of how bankruptcy restructuring can't cure all the ailments of a troubled company.

The Saab deal is the 3rd deal this year that has fallen through for GM. Earlier this year, a deal to sell Saturn to Penske Automotive Group (owned by Indycar racing legend Roger Penske) fell through due to financing troubles. Furthermore, a deal to sell GM's German brand - Opel - fell through because GM decided it was more prudent to keep the brand in house and restructure.

It's Not As Simple As You May Think

When GM initially declared bankruptcy, it stated that selling these 'non-core' assets was integral in their restructuring efforts. The thought on the street was that a bankruptcy would allow GM to clean its balance sheet and make these assets more attractive to buyers. Some even went as far as to say they would come out with a competitive advantage of other automakers because they will have paid down their debt levels drastically through the bankruptcy process.

I think it's obvious now that bankruptcy is not a magic ticket as some may have thought. If the company still makes poor products that continues to lose market share as is the case with GM, it will be a long, difficult process to come out of it. In the case of Saab, sales are down 61% over the past year. I find it hard to believe this little tidbit didn't scare Koenigsegg at all.

Where You Can Capitalize

So, we now know plenty about GM's troubles, but what does that mean to you? Well, like I said, you need to make great cars to be successful in the auto industry. A pre-packaged bankruptcy won't solve all your problems. Enter Ford. The only American automaker to not take government money, Ford took steps to sell some of its non-core assets before the economic downturn. It sold Jaguar to Tata Motors on what now seems to be a very very good price for the seller. It has also continued to invest heavily in new products while competitors were forced to cut back. It now has, by far, the freshest pipeline of new cars coming out of the Big 3.

Because of this and what I believe is the best management group in the industry (CEO Allan Mullaly was the head of Boeing Commercial Aircraft and got the hugely successful 787 program going before taking the Ford job), I feel that Ford is a great investment at its current price. I bought the stock a few months ago at $6.70 and it now trades near $9. That's a long way from the $1 it traded at in March. It continues to take marketshare from both domestic and foreign competition and I believe has great potential to capitalize on opportunities when auto sales finally recover. I would sell if the stock got close to $10, but would still keep a close eye on it.

The car industry is one of the most complex and challenging out there. Just ask Private Equity firm Cerberus, who's investment in Chrysler fell flat on its face in a real hurry. Because of this, picking winners and losers can (ironically) be a little easier because it's so hard to recover from a bad situation. GM still has a long way to go in its restructuring and will continue to hit bumps on this road. Long term I think it can succeed as well, but for now, Ford has a big leg up in the domestic auto market.

Questions/Comments/Feedback?

Please don’t hesitate to let me know of any questions or comments you have about this post or any other. If you want me to write about something else investing related, do let me know!

The Standard Disclaimer:

The stuff I just wrote above is my opinion and my opinion only. Please do not take it as fact. Perform all necessary research and analysis prior to acting on anything I've said above. This includes consulting with a financial advisor.

Wednesday, November 25, 2009

Sunday, November 15, 2009

The Deal with DROID

In my last post, I talked about Motorola's attempted resurgence with the new line of Android based phones known as the DROID. My thoughts were that the DROID would be the first and crucial step in Motorola finally returning to being a serious player in the handset market. I recommended MOT on the basis that the stock price/sales ratio is much cheaper than the industry, and, should the DROID be successful, the stock could easily move up to be comparable to its peers.

Well, the numbers are in! As John Paczkowski mentions in his article, there were 100,000 DROIDS sold during the launch weekend. Respectable numbers for a company that hasn't had a hit in a long time. However, there are some concerns I have about the future of the DROID. During the launch weekend, my brother-in-law and I made a trip to a local Verizon store to check out the DROID. He is out of contract with Verizon and, as a professional in the banking industry, is a perfect candidate for the DROID. I wanted to see the phone in person as well as talk to the store manager about traffic he's seen in an effort to gain insights on if my stock recommendation was accurate. Here's a few tidbits:

So the first experience with the DROID caused me to take pause on my recommendation and re-evaluate - something I recommend any investor to do, especially for riskier investments like MOT.

But then my brother-in-law sent me this. You can basically get the DROID 35% off if you sign a 2 year contract extension with VZN. This type of discounting so early in the products launch really caused me to take pause. If the DROID was doing really well, Verizon would have the pricing power to not offer these kinds of promotions...at elast for a while.

So, with all this information processed, my updated reommendation is a more cautious one for MOT. Yes the DROID has been selling well. It's launch weekend did fairly well. But there are indications that sales may drop of dramatically post-launch weekend. The stock closed on Friday at $8.78/share. I think that still gives the company fairly cheap valuation for a company that has a phone that's doing well. I would reccomend watching the DROID numbers very very closely during the holiday season. If this type of discounting continues and the sales are harder to keep up, then I would consider selling. At the very least, a close trailing stop should be applied to any positions to protect against potential bad news (I'd say around $8.50).

The DROID is an interesting phone and still has the potential of saving MOT's handset division. The company has already stated it wants to spin-off the unit, but it needs to be financially viable for it to do so. Hopefully the DROID sales can keep up and these indications I've been seeing are wrong. But there's no reason for everyday investors to get caught off-guard if the indications are right after all.

Questions/Comments/Feedback?

Please don’t hesitate to let me know of any questions or comments you have about this post or any other. If you want me to write about something else investing related, do let me know!

The Standard Disclaimer:

The stuff I just wrote above is my opinion and my opinion only. Please do not take it as fact. Perform all necessary research and analysis prior to acting on anything I've said above. This includes consulting with a financial advisor.

Well, the numbers are in! As John Paczkowski mentions in his article, there were 100,000 DROIDS sold during the launch weekend. Respectable numbers for a company that hasn't had a hit in a long time. However, there are some concerns I have about the future of the DROID. During the launch weekend, my brother-in-law and I made a trip to a local Verizon store to check out the DROID. He is out of contract with Verizon and, as a professional in the banking industry, is a perfect candidate for the DROID. I wanted to see the phone in person as well as talk to the store manager about traffic he's seen in an effort to gain insights on if my stock recommendation was accurate. Here's a few tidbits:

- According to the store manager, traffic was fairly quiet that weekend. I initially treated that as a negative for the DROID's prospects, but now it looks like that anecdotal data was an anomaly.

- The DROID itself was very heavy. Significantly heavier than the iPhone. My brother-in-law saw that as the biggest weakness for the phone, but not a deal breaker.

So the first experience with the DROID caused me to take pause on my recommendation and re-evaluate - something I recommend any investor to do, especially for riskier investments like MOT.

But then my brother-in-law sent me this. You can basically get the DROID 35% off if you sign a 2 year contract extension with VZN. This type of discounting so early in the products launch really caused me to take pause. If the DROID was doing really well, Verizon would have the pricing power to not offer these kinds of promotions...at elast for a while.

So, with all this information processed, my updated reommendation is a more cautious one for MOT. Yes the DROID has been selling well. It's launch weekend did fairly well. But there are indications that sales may drop of dramatically post-launch weekend. The stock closed on Friday at $8.78/share. I think that still gives the company fairly cheap valuation for a company that has a phone that's doing well. I would reccomend watching the DROID numbers very very closely during the holiday season. If this type of discounting continues and the sales are harder to keep up, then I would consider selling. At the very least, a close trailing stop should be applied to any positions to protect against potential bad news (I'd say around $8.50).

The DROID is an interesting phone and still has the potential of saving MOT's handset division. The company has already stated it wants to spin-off the unit, but it needs to be financially viable for it to do so. Hopefully the DROID sales can keep up and these indications I've been seeing are wrong. But there's no reason for everyday investors to get caught off-guard if the indications are right after all.

Questions/Comments/Feedback?

Please don’t hesitate to let me know of any questions or comments you have about this post or any other. If you want me to write about something else investing related, do let me know!

The Standard Disclaimer:

The stuff I just wrote above is my opinion and my opinion only. Please do not take it as fact. Perform all necessary research and analysis prior to acting on anything I've said above. This includes consulting with a financial advisor.

Monday, November 2, 2009

Is Moto Getting Its Mojo Back?

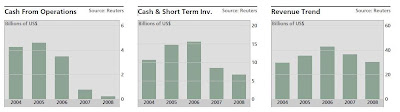

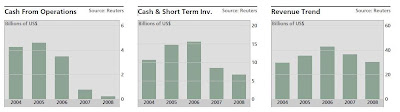

A few weeks ago, a good friend of mine asked me what I thought of Motorola (MOT) as a stock pick. My initial response was a resounding 'Run...run far far away'. For years, the company has been getting beaten up in the cell phone market by the likes of Apple and Research in Motion (the makers of Blackberry). Not since the MotoQ has MOT been able to come out with a phone that generated any sort of buzz. Not since the Razr has the company come out with a phone with significant buzz. Over the past 5 years, the company's earnings have declined by 29%. Why would anyone want to invest in in something like this??? I told my friend that I'd have to do more research, but my initial thought was stay away.

How Bad Is It?

Since that email, I've started reading up on MOT. From my readings, on paper, this company is a mess. Here's a few of the tidbits that are especially scary:

Even if you don't entirely know what these numbers mean, you can probably see that they're pretty ugly. But as I looked deeper into these numbers, I found something interesting. There's a classic theory in investing that Warren Buffet states best - "Be fearful when others are greedy. Be greedy when others are fearful." From the looks of it this saying can really apply to MOT. The numbers are so bad for this company that the market has a generally negative sentiment on the stock built in. You're going to be hard pressed to find someone (until very recently) that really likes the stock. Usually, this is the BEST time to buy that stock! Why? Because all the selling has already happened. Over-arching negativity usually signals a bottom for a stock. I think this applies to MOT right now. The stock is fairly cheap in terms of valuation (Price/Sales is 2.05 vs. 3.17 for the industry and Price/Book is similarly ratioed), and I don't think the market has factored in a successful product launch.

The New Buzz

But I'm not going to recommend a stock just because everyone hates it. Everyone hating the stock doesn't mean that the stock will go up. It just means there's a good chance it'll stop going down. What you need for the stock to go up is some sort of revamp at the company. For a company like MOT, this means new products. Over the last week I've been hearing A LOT about MOT's new phone - the Droid. This phone is supposed to be strong competition to the all powerful iPhone as well as the Blackberry. Coming out on 11/6, there's a few reasons why I think this phone is going to be a game changer:

Gotta Be Careful

There's a lot that MOT has going for it right now with Droid. But, as always, there's real risks associated with the stock

Bottom Line

I think MOT is a very intriguing investment at this point. You really have an opportunity here to buy a company that's trying to rebuild its brand and again become the leader it once was. Recently, an analyst at Citi upgraded MOT to a "Buy" AND downgraded RIMM and Palm to "Sell" because of the Droid. That's going out on a limb right there! But I don't totally disagree.

I would rate this stock a "Buy" long term. However, I think the stock has had a great run over the last couple of weeks (up 12%+ on Droid rumors). I would buy on a pullback to hopefully around $8.75 and sell if any indication comes up that Droid isn't selling well.

Questions/Comments/Feedback?

Please don’t hesitate to let me know of any questions or comments you have about this post or any other. If you want me to write about something else investing related, do let me know!

The Standard Disclaimer:

The stuff I just wrote above is my opinion and my opinion only. Please do not take it as fact. Perform all necessary research and analysis prior to acting on anything I've said above. This includes consulting with a financial advisor.

How Bad Is It?

Since that email, I've started reading up on MOT. From my readings, on paper, this company is a mess. Here's a few of the tidbits that are especially scary:

- Sales growth of -27% during the last quarter (much worse than the industry avg of approx -10%).

- Sales growth of -25% over the last twelve months (industry avg of -1.7%)

- Gross Margin of 28% compared to the industry avg of 53.6%

- Profit Margin of -16.9% compared to the industry avg of 5.6%

Even if you don't entirely know what these numbers mean, you can probably see that they're pretty ugly. But as I looked deeper into these numbers, I found something interesting. There's a classic theory in investing that Warren Buffet states best - "Be fearful when others are greedy. Be greedy when others are fearful." From the looks of it this saying can really apply to MOT. The numbers are so bad for this company that the market has a generally negative sentiment on the stock built in. You're going to be hard pressed to find someone (until very recently) that really likes the stock. Usually, this is the BEST time to buy that stock! Why? Because all the selling has already happened. Over-arching negativity usually signals a bottom for a stock. I think this applies to MOT right now. The stock is fairly cheap in terms of valuation (Price/Sales is 2.05 vs. 3.17 for the industry and Price/Book is similarly ratioed), and I don't think the market has factored in a successful product launch.

The New Buzz

But I'm not going to recommend a stock just because everyone hates it. Everyone hating the stock doesn't mean that the stock will go up. It just means there's a good chance it'll stop going down. What you need for the stock to go up is some sort of revamp at the company. For a company like MOT, this means new products. Over the last week I've been hearing A LOT about MOT's new phone - the Droid. This phone is supposed to be strong competition to the all powerful iPhone as well as the Blackberry. Coming out on 11/6, there's a few reasons why I think this phone is going to be a game changer:

- Viral Marketing - The fact that someone like me - by no means a techie - is hearing so much about this phone already means something. The blogs out there are overwhelmingly positive about the phone, and these guys are usually right.

- Android - The phone will be using Google's Android OS. MOT has always been weak in the OS field. Android will help right that ship while also making apps easy to create like AAPL and unlike Windows Mobile and Blackberry.

- Verizon's Hero - Cell phone carriers often pick a single phone to strongly promote in the hopes that it will bring in new customers while also forcing other phone makers to step up their marketing efforts. These so called 'Hero Programs' often help the phone makers by reducing marketing costs and increasing exposure. Verizon has selected Droid as a Hero Phone.

- Enterprise Email - Being able to get your work email on your phone is obviously important. But not all work email is the same. Getting your email to your blackberry costs your company a lot more than getting email to your Windows mobile phone. That's because Blackberry uses it's own proprietary technology to accomplish this. Android will use exchange server (same as Windows) for enterprise email. This will make corporate adoption significantly easier than was the case for Blackberry

Gotta Be Careful

There's a lot that MOT has going for it right now with Droid. But, as always, there's real risks associated with the stock

- MOT's new co-CEO has basically put all the company's R&D efforts on this phone. If it fails (think Palm Pre who had similar buzz), it can be catastrophic to the company.

- Read the numbers I mentioned above. They're still bad. They haven't shown much signs of improvement. Buying the stock means you're betting those numbers will improve, which may be more difficult than just one good product.

Bottom Line

I think MOT is a very intriguing investment at this point. You really have an opportunity here to buy a company that's trying to rebuild its brand and again become the leader it once was. Recently, an analyst at Citi upgraded MOT to a "Buy" AND downgraded RIMM and Palm to "Sell" because of the Droid. That's going out on a limb right there! But I don't totally disagree.

I would rate this stock a "Buy" long term. However, I think the stock has had a great run over the last couple of weeks (up 12%+ on Droid rumors). I would buy on a pullback to hopefully around $8.75 and sell if any indication comes up that Droid isn't selling well.

Questions/Comments/Feedback?

Please don’t hesitate to let me know of any questions or comments you have about this post or any other. If you want me to write about something else investing related, do let me know!

The Standard Disclaimer:

The stuff I just wrote above is my opinion and my opinion only. Please do not take it as fact. Perform all necessary research and analysis prior to acting on anything I've said above. This includes consulting with a financial advisor.

Subscribe to:

Comments (Atom)