How Bad Is It?

Since that email, I've started reading up on MOT. From my readings, on paper, this company is a mess. Here's a few of the tidbits that are especially scary:

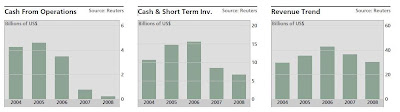

- Sales growth of -27% during the last quarter (much worse than the industry avg of approx -10%).

- Sales growth of -25% over the last twelve months (industry avg of -1.7%)

- Gross Margin of 28% compared to the industry avg of 53.6%

- Profit Margin of -16.9% compared to the industry avg of 5.6%

Even if you don't entirely know what these numbers mean, you can probably see that they're pretty ugly. But as I looked deeper into these numbers, I found something interesting. There's a classic theory in investing that Warren Buffet states best - "Be fearful when others are greedy. Be greedy when others are fearful." From the looks of it this saying can really apply to MOT. The numbers are so bad for this company that the market has a generally negative sentiment on the stock built in. You're going to be hard pressed to find someone (until very recently) that really likes the stock. Usually, this is the BEST time to buy that stock! Why? Because all the selling has already happened. Over-arching negativity usually signals a bottom for a stock. I think this applies to MOT right now. The stock is fairly cheap in terms of valuation (Price/Sales is 2.05 vs. 3.17 for the industry and Price/Book is similarly ratioed), and I don't think the market has factored in a successful product launch.

The New Buzz

But I'm not going to recommend a stock just because everyone hates it. Everyone hating the stock doesn't mean that the stock will go up. It just means there's a good chance it'll stop going down. What you need for the stock to go up is some sort of revamp at the company. For a company like MOT, this means new products. Over the last week I've been hearing A LOT about MOT's new phone - the Droid. This phone is supposed to be strong competition to the all powerful iPhone as well as the Blackberry. Coming out on 11/6, there's a few reasons why I think this phone is going to be a game changer:

- Viral Marketing - The fact that someone like me - by no means a techie - is hearing so much about this phone already means something. The blogs out there are overwhelmingly positive about the phone, and these guys are usually right.

- Android - The phone will be using Google's Android OS. MOT has always been weak in the OS field. Android will help right that ship while also making apps easy to create like AAPL and unlike Windows Mobile and Blackberry.

- Verizon's Hero - Cell phone carriers often pick a single phone to strongly promote in the hopes that it will bring in new customers while also forcing other phone makers to step up their marketing efforts. These so called 'Hero Programs' often help the phone makers by reducing marketing costs and increasing exposure. Verizon has selected Droid as a Hero Phone.

- Enterprise Email - Being able to get your work email on your phone is obviously important. But not all work email is the same. Getting your email to your blackberry costs your company a lot more than getting email to your Windows mobile phone. That's because Blackberry uses it's own proprietary technology to accomplish this. Android will use exchange server (same as Windows) for enterprise email. This will make corporate adoption significantly easier than was the case for Blackberry

Gotta Be Careful

There's a lot that MOT has going for it right now with Droid. But, as always, there's real risks associated with the stock

- MOT's new co-CEO has basically put all the company's R&D efforts on this phone. If it fails (think Palm Pre who had similar buzz), it can be catastrophic to the company.

- Read the numbers I mentioned above. They're still bad. They haven't shown much signs of improvement. Buying the stock means you're betting those numbers will improve, which may be more difficult than just one good product.

Bottom Line

I think MOT is a very intriguing investment at this point. You really have an opportunity here to buy a company that's trying to rebuild its brand and again become the leader it once was. Recently, an analyst at Citi upgraded MOT to a "Buy" AND downgraded RIMM and Palm to "Sell" because of the Droid. That's going out on a limb right there! But I don't totally disagree.

I would rate this stock a "Buy" long term. However, I think the stock has had a great run over the last couple of weeks (up 12%+ on Droid rumors). I would buy on a pullback to hopefully around $8.75 and sell if any indication comes up that Droid isn't selling well.

Questions/Comments/Feedback?

Please don’t hesitate to let me know of any questions or comments you have about this post or any other. If you want me to write about something else investing related, do let me know!

The Standard Disclaimer:

The stuff I just wrote above is my opinion and my opinion only. Please do not take it as fact. Perform all necessary research and analysis prior to acting on anything I've said above. This includes consulting with a financial advisor.

No comments:

Post a Comment